Why Playing It 'Safe' Is The Riskiest Move-Part 2

How to reframe 'RISK', stop confusing 'SAFE' with smart, plus a roadmap for Millennial investors to sleep at night while building wealth with confidence

NOTE: To do justice to the concept of Investment Risk, this post was divided in two parts, for ease of reading. This is Part 2.

Your free Personal Risk Framework building tool is at the end of this post. 👇

You can find Part 1 here along with the free Essential Investment Terms glossary with plain English definitions and examples.

This post is part of a 3-articles series on the essential guardrails of your investments:

On Risk Tolerance (current post + Part 1 )

On Time Horizon

Part 2 covers:

Advanced Risk Concepts For Experienced Investors

Risk Mistakes Advisors See Constantly

Real-World Risk Scenarios: Beyond Market Drops

International Diversification: A Global Perspective on Risk

Building Your Personal Risk Framework + Your free tool

Conclusion: Embracing Risk Without Fear

If you enjoy Wealth GPS, please subscribe and click the ❤️ button. It makes a bigger impact than you can imagine. Thank you for supporting our work.

You can read more in our Why Playing It Small Costs You Wealth post about how learning about risk and building your framework to handle it is part of the idea that you can become a better investor.

Making money is a skill and it can be learned.

Risk is one cornerstone of the mental model you need.

Advanced Risk Concepts (For Experienced Investors)

If you've been investing for a few years, these concepts can refine your thinking:

Sequence of Returns Risk

It's not just about average returns—it's about when you get them. Young investors should not be concerned about this, but getting poor returns early in retirement can devastate a portfolio, even if average returns are decent.

Solution: Consider bond tents or bucket strategies as you approach major withdrawals.

Factor Risk

The market isn't just "the market"—it's composed of factors like:

Value vs. Growth: Cheap stocks vs. expensive stocks

Size: Large companies vs. small companies

Momentum: Recent winners vs. recent losers

Quality: Profitable companies vs. unprofitable ones

Application: You can tilt your portfolio toward factors with higher expected returns (like value and small-cap), but be prepared for years when they underperform.

Correlation Risk

Diversification works until it doesn't. During crises, correlations spike—everything falls together.

Examples:

2008: Real estate, stocks, commodities all crashed

March 2020: Growth, value, international, bonds all fell initially

Different asset classes that normally zig-zag suddenly all zag

Solution: True diversification includes assets that respond to different economic conditions—stocks for growth, bonds for deflation, real assets for inflation.

Tail Risk

The fat tail events—crashes that "shouldn't" happen according to normal distributions but do anyway.

Examples: 1987 crash, 2008 financial crisis, March 2020 COVID crash

Solution: Position sizing, cash reserves, and avoiding (margin) leverage. You can't predict tail events, but you can survive them.

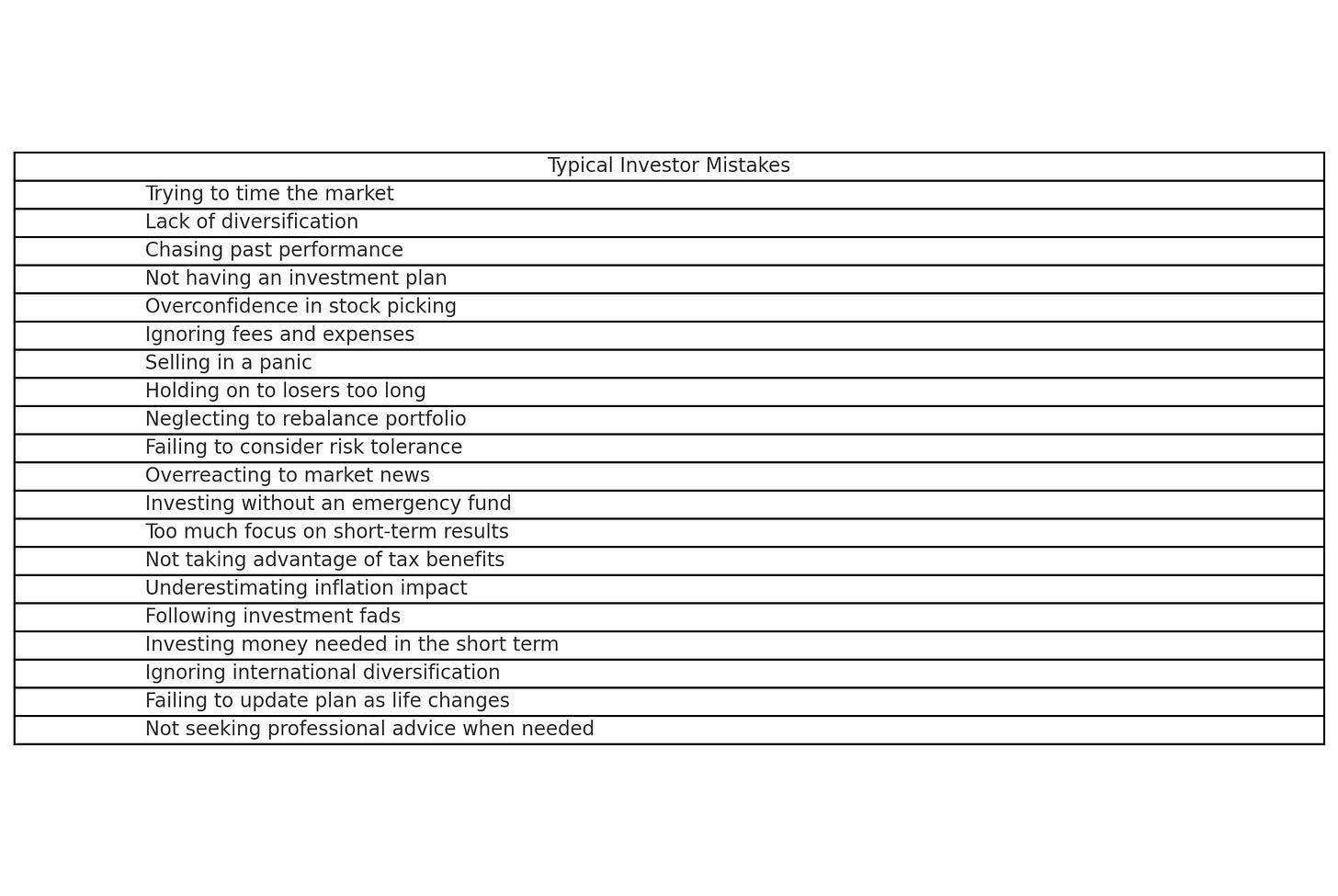

Risk Mistakes Advisors See Constantly

Mistake #1: Conflating Volatility with Risk for Long-Term Money

A 30-year-old putting retirement money in CDs because they're "safer" than stock funds. The volatility can be scary, but the inflation risk is the real beast. Remember the chart in Part 1.

Mistake #2: Taking Zero Risk with Decades-Long Time Horizons

Keeping a 40-year retirement timeline invested in savings accounts earning under 3% while inflation runs 3%+.

Mistake #3: Taking Too Much Risk with Short-Term Money

Investing next year's house down payment in growth stocks because "the market always goes up." It does—eventually.

Mistake #4: Abandoning the Plan After Market Drops

Selling everything after a 20% decline, then watching from the sidelines as markets recover and reach new highs.

Mistake #5: Chasing Performance After Missing Gains

Rotating into whatever performed best last year, consistently buying high and selling low.

Mistake #6: Lifestyle Risk Creep

As income grows, increasing spending instead of saving. The biggest risk to wealth building isn't market crashes—it's never starting investing meaningful amounts because we overspend and under-save.

Real-World Risk Scenarios: Beyond Market Drops

Scenario 1: Job Loss During Market Downturn (2008-style)

Your portfolio is down 30%, and you lose your job. Without an emergency fund, you're forced to sell investments at the worst time.

Lesson: Emergency funds aren't about market crashes—they're about life crashes. Have one in place to catch you.

Scenario 2: Health Crisis Requiring Early Portfolio Access

You need $50,000 for medical treatment, but it's all tied up in retirement accounts with penalties, or in investments that are currently down.

Lesson: Keep some money accessible outside of retirement accounts. Stuff happens.

Scenario 3: Inflation Spike (1970s-style)

Your "safe" bond portfolio gets crushed as interest rates rise. Your cash loses purchasing power rapidly.

Lesson: Different economic environments create different risks. Diversify across asset classes.

Scenario 4: Concentration Risk

Your employer's stock (where 40% of your net worth is invested) gets hit by a scandal and loses 60% in one day.

Lesson: Never let any single investment—even a "sure thing"—dominate your portfolio.

International Diversification: A Global Perspective on Risk

For millennial investors thinking globally, international diversification adds another layer:

Currency Risk

When you invest internationally, you're also betting on currency movements. A European stock could gain 10% in euros but you could lose money if the euro weakens against the dollar. Remember this is temporary. Reversion to the mean will take care of this ‘paper loss’ given some time-align your investments with your time horizon.

Political Risk

Different countries have different regulatory environments, tax policies, and political stability. Things can change overnight.

Market Cycle Risk

U.S. markets don't always lead global markets. Sometimes international markets outperform for years at a time.

The Balance: International diversification reduces single-country risk but adds currency and political risk. For most investors, a mix (like 70% U.S., 30% international) balances these trade-offs.

Building Your Personal Risk Framework

Whether you're new to investing or have a few years under your belt, here's how to make peace with risk:

Step 1: Start with the First Cornerstone

Always ask: Risk to whom? Risk compared to what? Your risk isn't your neighbor's risk.

Step 2: Anchor on the Second Cornerstone

Clarify your ability, need, and willingness—and notice when they're out of balance.

Step 3: Separate Risk from Volatility

Don't confuse short-term noise with long-term danger. One is temporary discomfort, the other is permanent erosion.

Step 4: Mind Your Behavior

Markets can't control your decisions, but your decisions can ruin your returns. Plan for your own psychology. Rule #1 in investing: Investor, know thyself!

Step 5: Build Your Risk Budget

Decide how much risk you can handle, then spend it wisely across different types of growth opportunities.

Step 6: Match Risk to Time Horizon

Use the 0-3 years, 3-10 years, 10+ years framework to guide your allocation decisions.

Step 7: Plan for Scenarios Beyond Market Drops

Emergency funds, liquidity needs, job changes, health events—life risk often matters more than market risk.

Step 8: Accept Risk as Managed, Not Eliminated

Diversification, planning, and discipline don't erase risk, but they make it manageable.

Your free Personal Risk Framework building tool is below 👇

Conclusion: Embracing Risk Without Fear

Risk is not one thing. It's a reality with many faces, from inflation to volatility to your own emotions. It can feel overwhelming, even unfair.

The good news: risk is always manageable.

For DIY investors, it can mean a diversified index portfolio, patience, and consistency. For those working with an advisor, it means building a portfolio calibrated to your ability, need, and willingness—and adjusting as life changes.

Feelings will tempt you to retreat. But feelings aren't facts. Educate yourself, lean on time-tested strategies, and remember: time, returns, knowledge and experience will take the sting out of fear.

No one is born knowing how to invest. You learn. You practice. You get better. Money-care is self-care. Investing is a process of growth—your money grows, and so do you. The tools are available, the strategies are proven, and the resources are endless.

Risk is the price of admission. But it's also the ticket to freedom, independence, and goals met.

Then the question for you is: How will you build your own system for living with risk—one that lets you grow, sleep at night, and reach the future you want?

Ready to build your Personal Risk Framework? Download the free companion tool below to turn these concepts into action 👇

Join a community of readers learning from a former certified financial planner who managed millions and guided families through every life stage. Get proven tools, clear insights, and practical advice you can use today.

Note: Followers can only discover content by stumbling across a Note. Instead, Subscribers receive each article as it is published and access the entire archive.

You can find Part 1 of this article here.

Next Week: Investment Objectives. What Are They All About?

Thank you for reading,

Elizabeth

Wealth GPS

Disclaimer: The content in this publication is for informational and entertainment purposes only. It reflects the personal opinions of the author and should not be considered financial advice, recommendations, or a solicitation to buy or sell any financial products. Posts are written for a general audience and do not consider your specific financial situation. The author is a former financial planner and does not offer financial planning or advisory services through this publication.

Substack thrives on thoughtful conversation and sharing; feel free to re-stack this post, share it with others, or write your own Notes in response. You’re also welcome to download and use any free tools or resources provided; they were created you in mind and they are yours to keep. If you’d like to repost or quote from this article elsewhere, please credit the source and link back. For anything beyond brief excerpts, just reach out for permission.